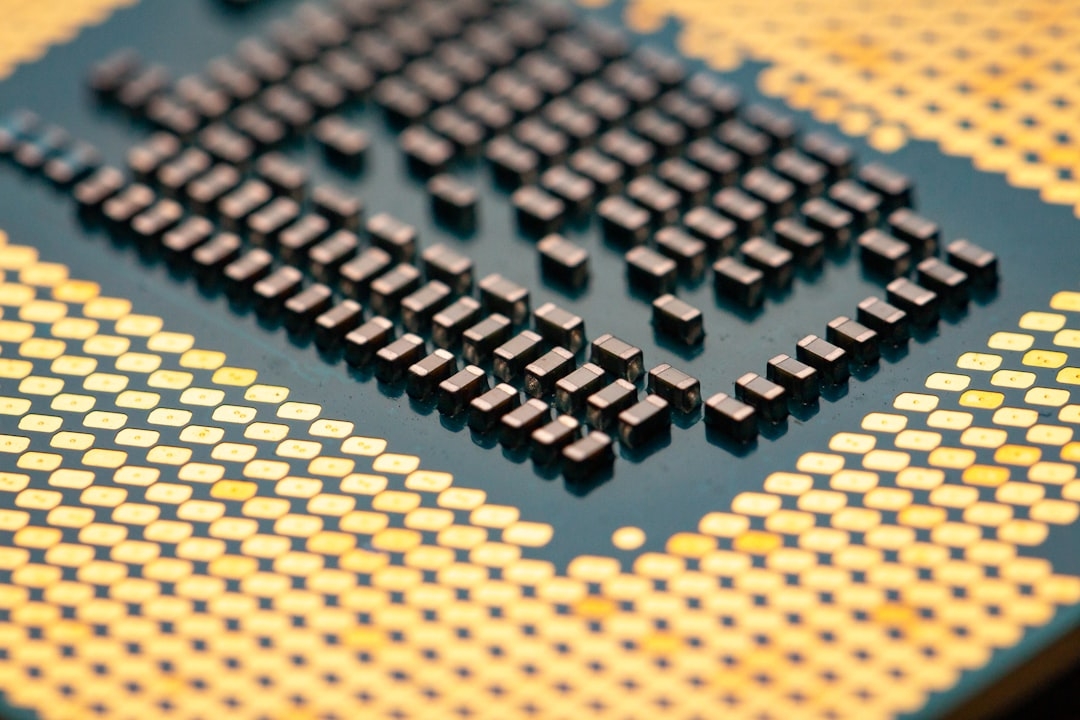

You might recall the buzz around US semiconductor dominance—until last year, when things shifted more than expected. From leadership shake-ups at major legacy companies to unclear export policies, 2025 wasn’t just another year; it was a turning point. Having followed this industry closely, I saw firsthand how decisions and uncertainty impacted manufacturers and supply chains.

What happened with leadership changes at legacy semiconductor companies?

In 2025, several established semiconductor giants went through significant leadership reshuffling. These changes weren’t just cosmetic; they reflected deeper strategic shifts as companies grappled with global competition and innovation demands. Leaders who once emphasized traditional chip manufacturing now faced pressure to invest heavily in new technologies like advanced node development and heterogeneous integration.

Legacy companies included household names that have dominated the market for decades. Their leadership switches aimed to accelerate adaptation to emerging trends but also revealed internal challenges—such as aligning R&D priorities and managing legacy production facilities.

Why do leadership shifts matter to you?

Leaders set the tone and direction. If strategies shift midstream, you might see delays in product releases or changes in the availability of specific semiconductor products. For businesses relying on these chips, this can mean supply unpredictabilities and riskier planning horizons.

How did US chip export policies impact the market in 2025?

Export controls on semiconductor technologies have been a contentious topic for years, but 2025 saw a particularly uncertain approach from US policymakers. The policies around chip exports, especially to select countries, were described as “wishy-washy” because of inconsistent enforcement and unclear guidelines.

This ambiguity created headaches across the supply chain. Manufacturers and international buyers struggled to interpret compliance requirements, which slowed trade and clouded investment decisions.

Export controls refer to government restrictions on sending technology or products abroad, typically for national security or competitive reasons. In semiconductors, these controls affect advanced chips, manufacturing equipment, and intellectual property.

Where did export policies fall short?

The inconsistency in communication and application meant companies had to operate in a reactive mode rather than strategic. This unpredictability discouraged long-term investments and strained US semiconductor competitiveness globally.

The Hype vs Reality: Is the US still leading in semiconductors?

The hype around the US regaining semiconductor leadership is strong, but reality shows a more nuanced picture. While the US remains a powerhouse in chip design and equipment manufacturing, the actual production share domestically is still limited compared to Asia-based foundries.

Government initiatives to boost local manufacturing are promising but face challenges such as high capital expenditure, talent shortages, and supply chain complexity.

What makes semiconductor manufacturing so challenging?

Building leading-edge semiconductor fabs involves enormous investment in equipment, highly specialized materials, and a skilled workforce. The process requires photolithography—a technique to etch microscopic circuits on silicon wafers—which demands cleanroom environments and consistent innovation in fabrication methods.

Where does the US semiconductor market shine?

- Chip design: US companies remain global leaders in innovative chip architectures and IP.

- Equipment and materials: Many critical tools and chemicals used in fabs worldwide come from US firms.

- Research institutions: Collaboration of industry with top US universities advances semiconductor science.

Where does it fall short?

- Manufacturing scale: Limited number of fabs compared to competitors in East Asia.

- Policy clarity: Ambiguous export regulations hamper smooth international cooperation.

- Supply chain dependencies: Key raw materials and some fabrication steps still rely on foreign sources.

What alternatives are available to navigate these market realities?

Companies and policymakers are exploring diversified strategies such as:

- Expanding partnerships with friendly countries for chip production and material sourcing

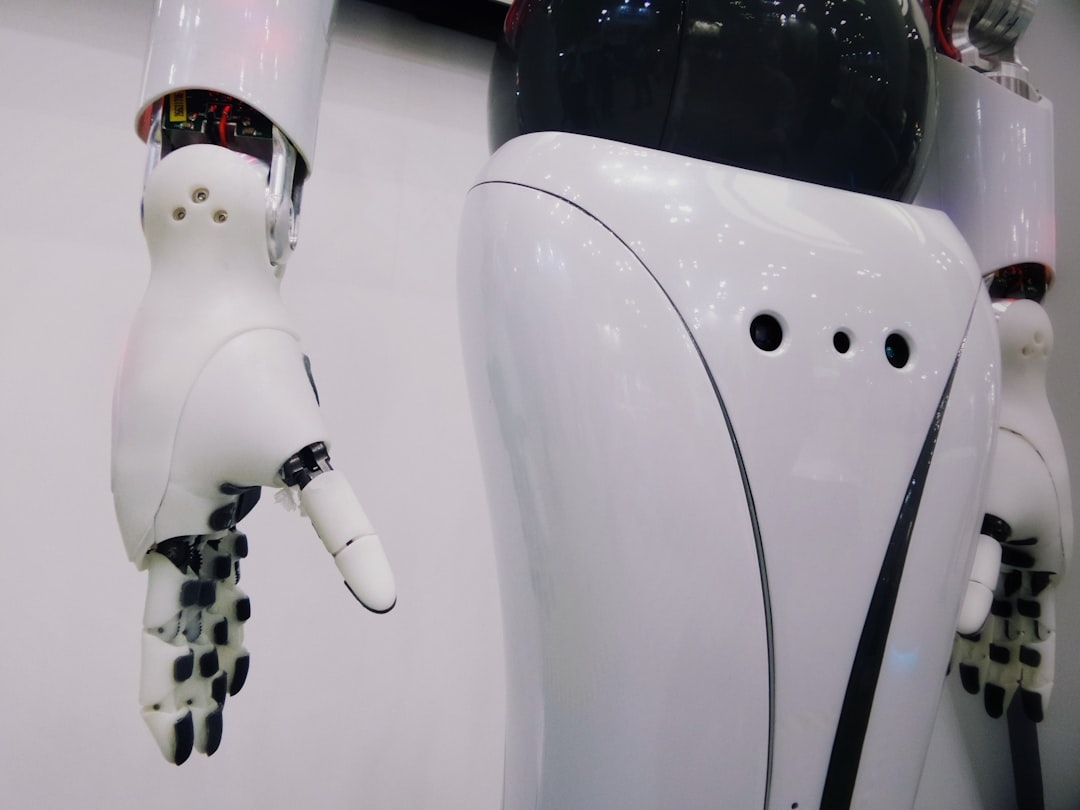

- Investing in emerging chip technologies like chiplets and advanced packaging to improve scalability

- Encouraging workforce development programs to alleviate talent shortages

Chiplets are smaller chip components combined into a larger functional unit, which can reduce manufacturing complexity and costs.

Can you rely solely on US semiconductor supply chains in 2025?

Given current dynamics, relying entirely on US domestic supply is risky. The international semiconductor ecosystem remains interconnected, and navigating trade policies and supply availability requires careful planning.

Businesses should evaluate risk, diversify sourcing, and maintain clear compliance processes to avoid disruptions.

Comparison Matrix: US Semiconductor Market in 2025

| Aspect | Strengths | Weaknesses |

|---|---|---|

| Leadership | Experienced industry veterans leading innovation | Frequent strategy shifts causing uncertainty |

| Manufacturing | Cutting-edge R&D in design | Limited domestic fab capacity |

| Policy | Strong intent to boost local industry | Unclear export rules hurting trade |

| Supply Chain | Diverse equipment and materials suppliers | Dependence on foreign raw materials |

Practical Steps to Address Semiconductor Supply Issues

If you are facing semiconductor sourcing problems, try this quick action plan in 20-30 minutes:

- Map your critical semiconductor components and their current suppliers.

- Identify any reliance on suppliers affected by export restrictions.

- Research alternative suppliers in more stable regulatory environments.

- Reach out to your legal or compliance team to verify export control policies related to your supply chain.

- Develop a basic contingency plan prioritizing alternative sourcing routes.

This diagnostic approach helps spot vulnerabilities early and prepares you for fluctuating market conditions.

By understanding the recent shifts in leadership and policy, and appreciating the trade-offs in semiconductor manufacturing and supply, you can navigate 2025’s landscape more confidently.

Technical Terms

Glossary terms mentioned in this article

Comments

Be the first to comment

Be the first to comment

Your opinions are valuable to us