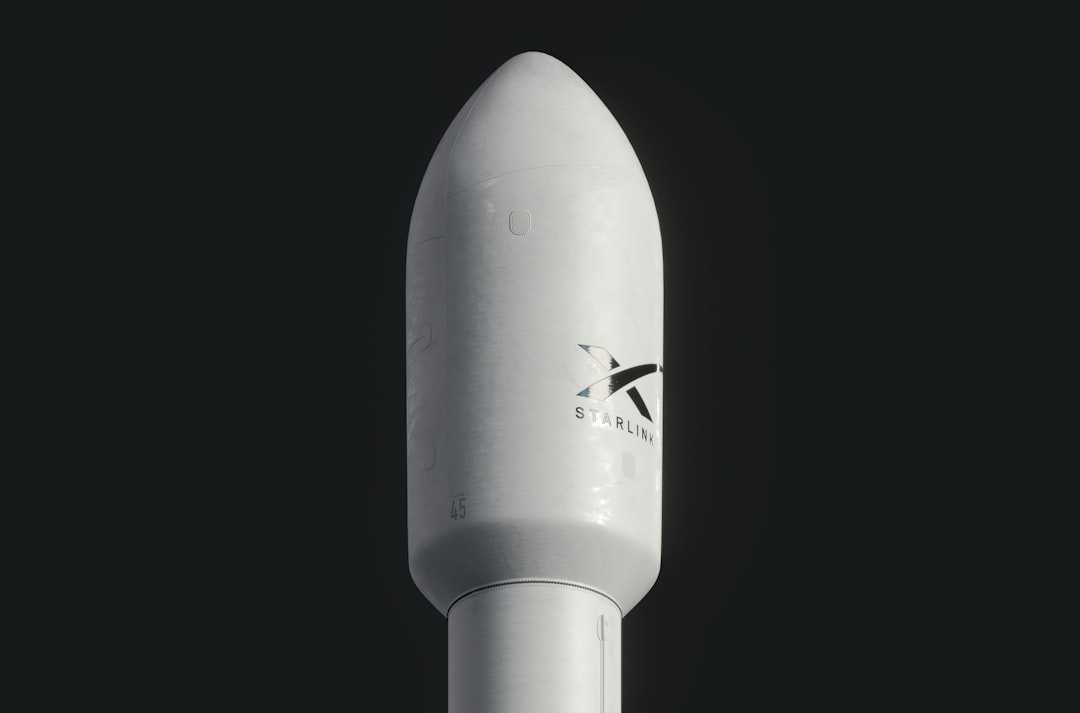

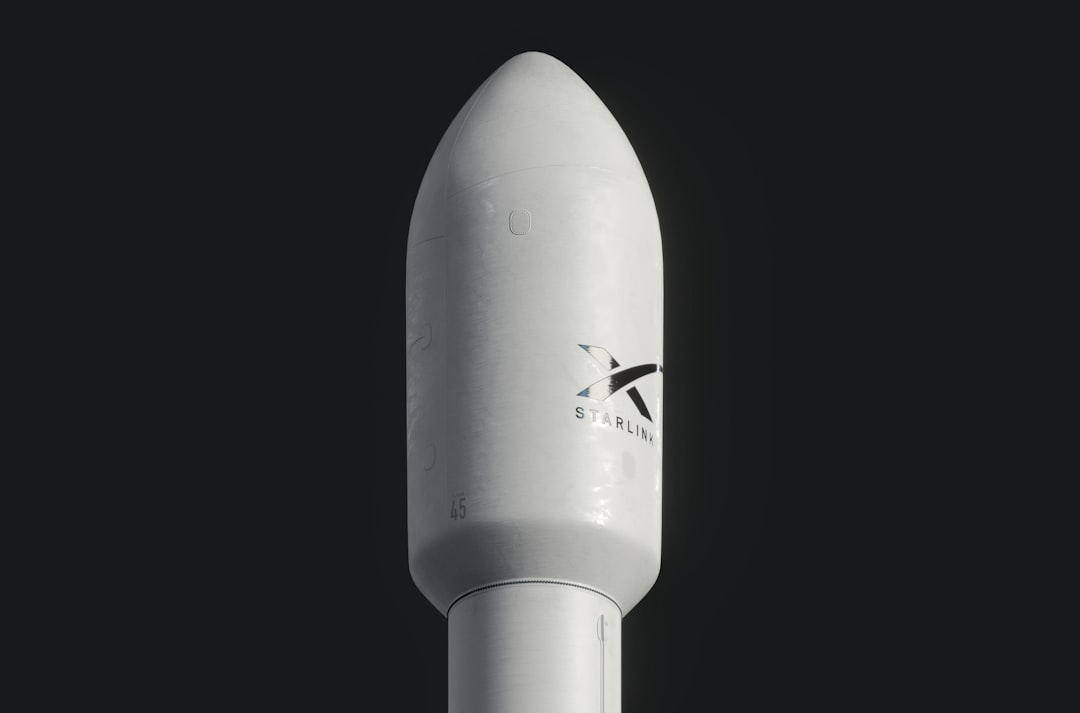

The talk of SpaceX going public has stirred a fresh wave of excitement in the investment world. As one of the most high-profile private companies, SpaceX’s rumored initial public offering (IPO) raises important questions about what happens before a company officially hits the stock market. Particularly, how does private liquidity work, and what should investors expect in this pre-IPO phase?

Understanding SpaceX’s IPO chatter has significant implications. It sheds light on the evolving landscape of private companies, secondary markets, and investor strategies seeking exposure to innovative, high-growth firms before they become publicly traded.

What Exactly Is Private Liquidity, and How Does It Work?

Before a company like SpaceX goes public, its shares typically remain held by founders, early employees, and venture capitalists. However, not everyone wants to wait years for an IPO or acquisition to cash out. This is where private liquidity solutions come in.

Private liquidity refers to secondary markets or transactions allowing current shareholders to sell some of their shares to outside investors before the company lists publicly. It’s different from an IPO because the company itself doesn’t issue new shares or raise capital at that point—just existing shares change hands.

Why Are Secondary Markets Booming?

In recent years, the rise of secondary market platforms has enabled broader access to private company shares. Investors can find stakes in firms like SpaceX, even though they are not publicly listed. This has created a more dynamic market for pre-IPO equity.

For instance, employees looking to diversify their investments can sell some stock options without waiting. Meanwhile, investors hungry for growth opportunities can participate by buying shares on these secondary platforms, albeit usually at a premium due to scarcity.

How Does SpaceX’s Potential IPO Affect This Market?

When an IPO is anticipated, liquidity in secondaries generally heats up as investors try to position themselves before shares become publicly tradable. The possibility of SpaceX going public soon has led to increased trading volumes, and the market for its private shares is particularly lively.

Greg Martin, managing director at Rai, highlights that space companies like SpaceX attract interest not only because of their innovative technology but also due to the growing appetite for investments in new space ventures.

The Hype vs. Reality of Pre-IPO Investments

It’s easy to assume that buying pre-IPO shares is a guaranteed path to big profits. However, secondary markets can be unpredictable. Pricing is often opaque, and these shares can be illiquid, making it hard to exit if needed. Also, there are regulatory considerations which can limit who is eligible to trade.

For example, a tech employee selling shares for liquidity could face limitations on how much can be sold and when, depending on company policies and lock-up agreements tied to the eventual IPO.

What Are Investors Looking For in Pre-IPO Giants Like SpaceX?

Investors seeking private shares usually evaluate:

- Growth potential: Companies like SpaceX push frontiers, making them attractive for long-term gains.

- Market positioning: SpaceX’s dominance in space transport and satellite internet projects underlines its leadership.

- Financial health: Profitability remains a question; many private companies show rapid revenue growth but are still cash flow negative.

- Exit timeline: Investors want clarity on when the IPO or acquisition might happen to understand their liquidity horizon.

Buyers need to weigh these factors carefully, balancing enthusiasm with realism about risks and market conditions.

When Should You Consider Trading on Secondary Markets Before an IPO?

If you’re an investor exploring private markets, timing is everything. Secondary shares often trade at a premium due to scarcity, yet buying too early can tie up capital for years if the IPO is delayed or valuation dips.

Expert advice suggests monitoring proxy indicators like regulatory filings, company announcements, and insider trading activity to gauge IPO likelihood. Ensuring you are accredited or meet other eligibility criteria is also essential, as many pre-IPO shares are restricted to qualified investors.

Alternatives to Pre-IPO Investments

If direct secondary market trading seems risky or inaccessible, consider other investment vehicles:

- Venture capital funds: Indirect exposure through funds that specialize in late-stage tech startups.

- SPACs (Special Purpose Acquisition Companies): These have become popular alternatives, enabling investment in companies merging with SPACs to get public faster.

- Sector ETFs: Investing in space tech or related innovation exchange-traded funds for diversified exposure.

Each alternative carries its own risk/reward profile and liquidity considerations.

What to Keep in Mind When Dealing with Pre-IPO Shares?

Handling pre-IPO investments requires attention to compliance, valuation, and timing. Secondary liquidity is not guaranteed; sales often need company approval, and discounts or premiums to fair value are common due to market conditions.

For instance, owning private shares can feel like holding a rare collectible—you may want to sell, but finding the right buyer at the right price takes patience and strategy.

Steps to Evaluate and Enter Pre-IPO Markets

Here is a practical checklist for investors interested in private shares like SpaceX:

- Verify eligibility and understand restrictions on trading and holding.

- Research the company's latest financials, market trends, and IPO signals.

- Assess your risk tolerance honestly; these investments can be volatile and illiquid.

- Use reputable secondary market platforms with transparent pricing.

- Stay informed about possible changes in company strategy or regulatory environments.

This structured approach helps avoid common pitfalls often seen in competitive, high-demand private markets.

What’s Next For Investors Eyeing SpaceX and Similar Pre-IPO Titans?

The excitement around SpaceX’s potential IPO is a reminder of how dynamic the pre-public investment landscape has become. As companies stay private longer, secondary markets will likely remain an essential gateway for investors eager to access promising firms early.

However, success depends on thorough research, realistic expectations, and navigating the trade-offs between liquidity, valuation, and risk.

Investing in that market is less about chasing hype and more about disciplined, informed decision-making.

Ready To Explore Private Shares? Here’s a 20-Minute Action Plan

If you want to start evaluating or trading private shares, take these steps to get organized:

- Confirm your accreditation or eligibility to invest in private securities.

- Identify a credible secondary market platform offering shares in companies like SpaceX.

- Review recent company disclosures and news for IPO signals.

- Set your investment budget and risk parameters.

- Initiate a small-scale purchase to understand the transaction and settlement process.

By focusing on manageable, concrete tasks, you’ll gain practical experience and clarity in navigating the exciting but complex pre-IPO space.

Technical Terms

Glossary terms mentioned in this article

Comments

Be the first to comment

Be the first to comment

Your opinions are valuable to us