Insurance has long been an industry resistant to rapid technological disruption, often due to complex regulations and conservative risk models. Yet, Ethos, an insurance technology company, is challenging these norms. Poised to launch as possibly the first tech IPO of 2024, Ethos's entrance into the public market carries weight given its financial health and high-profile backing.

Founded with a mission to simplify life insurance, Ethos's technology-driven approach aims to make purchasing insurance faster and more accessible. The fact that it claims profitability at this stage is notable in an era where tech startups often prioritize growth over earnings.

What Problems Does Ethos Solve in Traditional Insurance?

Traditional life insurance processes are often slow, paperwork-heavy, and confusing for customers. Physical medical exams, lengthy underwriting, and opaque policy terms frequently cause potential buyers to delay or abandon coverage. Ethos addresses these bottlenecks by leveraging digital tools to streamline application and approval.

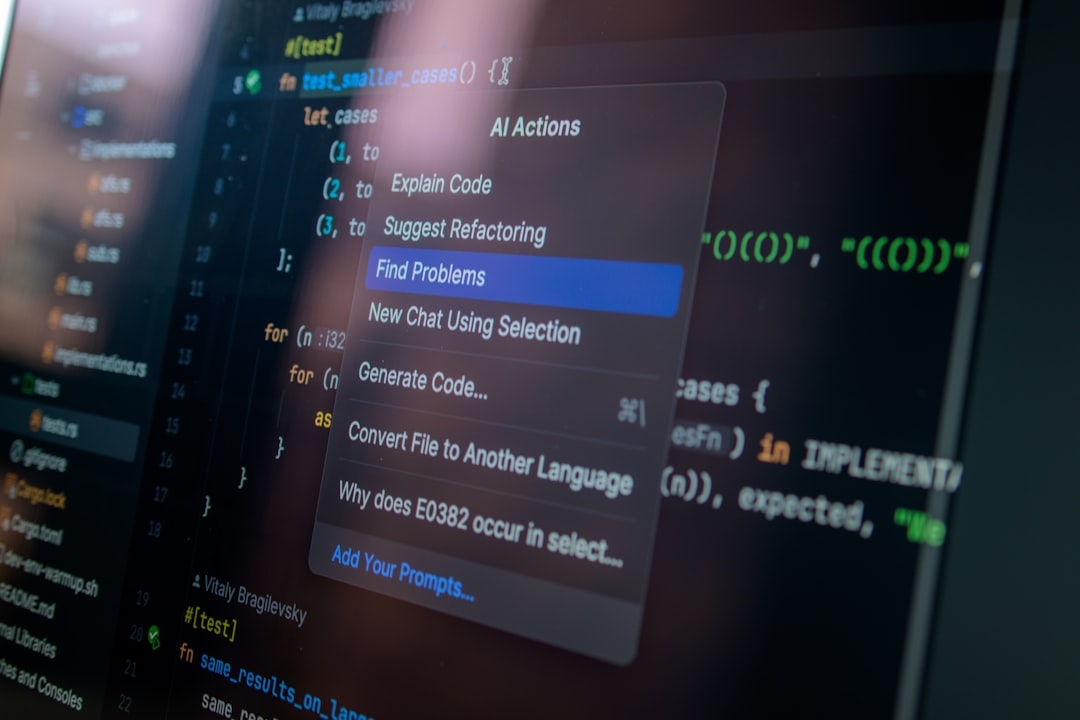

Its platform uses automated underwriting algorithms combined with health data to bypass many manual steps. This means decisions can be faster without sacrificing risk assessment quality — a crucial balance in insurance where risk evaluation must remain rigorous.

How Does Ethos’s Technology Work in Practice?

Ethos's platform integrates multiple data sources, including third-party health databases and advanced algorithms, to assess applicants' risk profiles quickly. By automating underwriting and removing medical exam requirements in many cases, Ethos aims for efficiency. This is key to scaling insurance offerings at a low cost.

Importantly, while technology reduces friction for customers, the system still respects regulatory frameworks and actuarial principles. This pragmatism is likely a factor in Ethos achieving profitability, unlike many tech startups that sacrifice income for rapid expansion.

Why Is Ethos's Backing Significant?

Throughout 2021, Ethos attracted investment from a who's who of venture capital firms and celebrity investors. This level of endorsement suggests confidence in both its market opportunity and product execution. Such support can ease challenges in scaling insurance tech, where customer trust and capital are paramount.

What Does Being 'Profitable' Mean for Ethos?

In the tech startup world, profitability is often elusive, especially for companies prioritizing growth before earnings. Ethos’s claim of profitability signals a solid business model with operational discipline. This stands out in insurance tech, an area where regulatory complexity and capital intensity often delay profitability milestones.

When Should You Pay Attention to Ethos’s IPO?

As the first tech IPO candidate of 2024, Ethos’s performance will draw close scrutiny. Market reception will reveal investor appetite for insurance tech companies balancing innovation and profitability.

Investors and industry watchers will assess whether Ethos can sustain growth, expand market share, and maintain financial health under public scrutiny. The IPO’s outcome may set benchmarks for similar companies seeking to go public.

Key Takeaways and What Comes Next

- Ethos is a profitable insurance tech company aiming to simplify life insurance via automation and digital tools.

- Its access to health data and smart algorithms reduces the need for traditional medical exams.

- Strong venture and celebrity backing underscore confidence in its business model.

- The IPO will test if profitability and tech innovation can align in insurance on a public market stage.

For those evaluating Ethos or similar ventures, consider how technology can navigate regulatory complexity without compromising risk quality. The real test is sustainable profitability combined with customer trust.

Evaluation Framework: In 10-20 minutes, assess a tech startup’s readiness for IPO by reviewing:

- Profitability status and revenue trends.

- Customer acquisition cost versus lifetime value.

- Regulatory hurdles and risk management approaches.

- Backing by credible investors and operational leadership.

This checklist helps quickly gauge if a company balances innovation with sound financials—key for insurance tech firms entering public markets.

Technical Terms

Glossary terms mentioned in this article

Comments

Be the first to comment

Be the first to comment

Your opinions are valuable to us