When Meta announced its partnership with Oklo to finance the purchase of uranium for Oklo’s advanced nuclear reactors, it caught my eye. Having observed the often turbulent development of alternative energy startups, this move stands out as a major endorsement of nuclear technology’s comeback. But what does this actually mean for the future of energy?

Meta’s commitment to fund uranium acquisition signals a deep confidence not just in Oklo’s innovative reactor designs, but also in nuclear power as a viable clean energy source. This gesture is momentous in an era where decarbonization goals push companies to explore diverse energy solutions beyond solar and wind.

What Makes Meta’s Investment in Oklo Significant?

Oklo is not your standard nuclear player. It focuses on small modular reactors (SMRs), which are compact, scalable nuclear reactors designed to be safer and more adaptable than traditional large reactors. Securing uranium is critical because uranium fuel powers these reactors. Meta financing this purchase removes a major hurdle for Oklo, accelerating the path from design to operation.

Small Modular Reactors (SMRs) are a key part of the advanced nuclear landscape because they potentially offer quicker installation and reduced upfront costs. Unlike conventional plants, which can take a decade or more to build, SMRs aim to deliver nuclear energy on a more manageable timeline.

How Does Oklo’s Approach Compare to Traditional Nuclear?

Traditional nuclear power relies on large, centralized plants using uranium fuel in complex reactors. Oklo’s SMRs are smaller in size, use advanced materials and designs, and promise enhanced safety features. That's partly why interest from a tech giant like Meta is a game-changer—it validates nuclear's modernization efforts.

However, while SMRs bring innovation, they are still subject to rigorous regulatory approval, supply chain constraints, and long development cycles, which means it might be years before they contribute significantly to the grid.

What Challenges Does This Nuclear Bet Face?

Despite the enthusiasm, nuclear energy projects—SMRs included—face several hurdles:

- Regulatory Barriers: Nuclear power is heavily regulated. Obtaining safety certifications takes time and can stall progress.

- Supply Chain Limitations: Uranium availability and fabrication of specialized reactor components currently lack scalability.

- High Initial Costs: While SMRs reduce some expenses, upfront investment remains substantial.

- Public Perception: Historical safety concerns and nuclear waste management issues impact acceptance.

Meta’s financing addresses one part of this puzzle by ensuring Oklo’s uranium supply but does not eliminate all operational and societal challenges.

Where Does Nuclear Power Shine Compared to Other Clean Energies?

Nuclear power offers unique advantages that complement intermittent renewables like solar and wind:

- High Energy Density: A small amount of uranium produces vast energy compared to fossil fuels or renewables.

- Reliable, Round-the-Clock Power: Nuclear plants provide stable baseload energy unaffected by weather or daylight.

- Low Carbon Emissions: Nuclear production emits virtually zero greenhouse gases during operation.

These factors make nuclear a strong contender for balancing energy grids and meeting stringent climate targets.

Are There Alternatives to Oklo’s Nuclear Model?

If you’re weighing clean energy options or concerned about nuclear’s challenges, consider these alternatives:

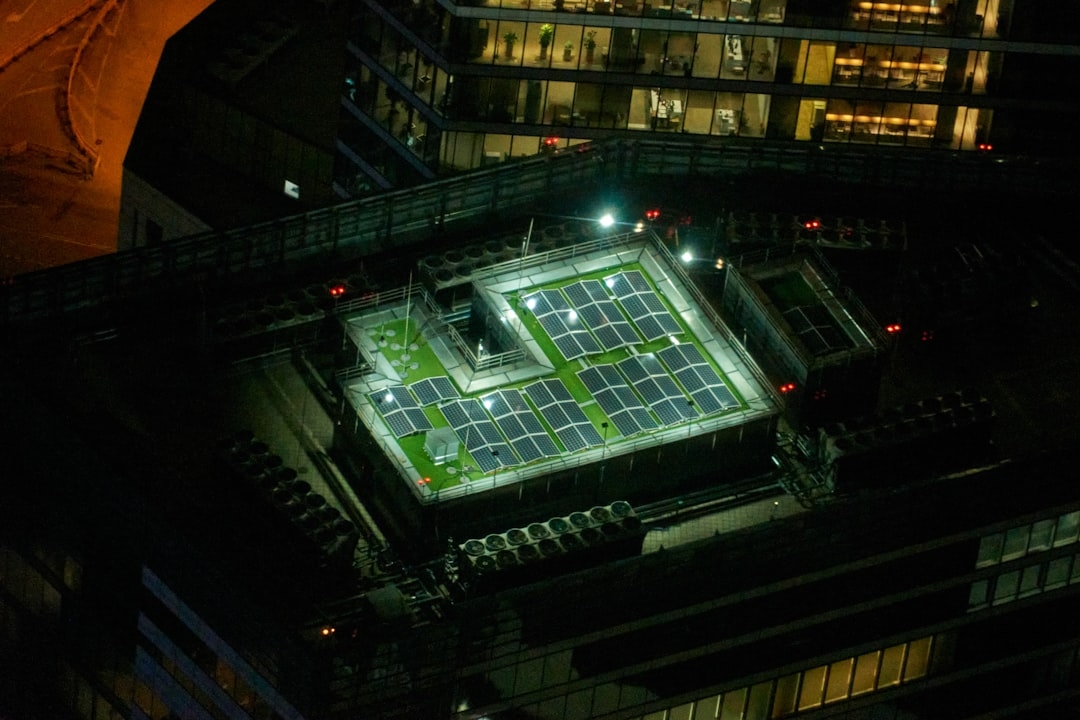

- Renewables with Energy Storage: Solar and wind paired with battery systems dominate current market growth.

- Hydrogen Fuel: An emerging storage and fuel option to handle renewables’ intermittency.

- Traditional Nuclear Plants: Established but slower and more costly to scale.

- Advanced Reactor Designs from Other Startups: Competitors experiment with molten salt or thorium reactors aiming for safety and efficiency improvements.

Each option has trade-offs in cost, scalability, and timeline, which is why a diversified clean energy mix remains crucial.

How Do You Assess If Nuclear Is Right for Your Energy Strategy?

When evaluating energy investments or policies, ask these questions:

- What is the timeline for energy demand and emissions reductions?

- Are regulatory frameworks supportive and mature enough?

- Can supply chains reliably support fuel and components?

- Is public trust sufficient to move projects forward?

Oklo’s innovation and Meta’s support push nuclear forward, yet realistic timelines and transparent communication remain essential.

Summary Table: Meta-Oklo Nuclear Investment vs Other Clean Energy Options

| Criterion | Meta-Oklo SMRs | Solar + Storage | Traditional Nuclear | Hydrogen Energy |

|---|---|---|---|---|

| Energy Density | High | Low | High | Medium |

| Likelihood of Deployment (Next 5 Years) | Low-Medium | High | Low | Low |

| Reliability | High | Variable | High | Medium |

| Capital Costs | High | Declining | Very High | High |

| Environmental Impact | Low Carbon, Waste Concerns | Low Carbon | Low Carbon, Waste Concerns | Low Carbon |

Final Thoughts on Meta’s Nuclear Bet with Oklo

Meta’s move to fund uranium purchase for Oklo represents a noteworthy infusion of trust and capital into next-generation nuclear technology. This partnership highlights nuclear’s potential role in a low-carbon energy future while underscoring persistent challenges including regulatory, financial, and societal factors.

Whether SMRs or other advanced reactors become mainstream depends on overcoming these hurdles and integrating nuclear thoughtfully alongside renewables and emerging technologies. Meta’s support could help accelerate progress, but patience and pragmatic planning remain indispensable.

Step-by-Step Task: How to Evaluate Nuclear Prospects for Your Energy Project

- Identify your project's energy requirements and timeline.

- Research local regulatory landscape for nuclear or alternative energies.

- Assess supply chain readiness (fuel access, technology availability).

- Compare investment and operational costs of nuclear vs renewables.

- Gauge community and stakeholder attitudes towards nuclear power.

This 20-30 minute exercise can clarify if advanced nuclear solutions like Oklo’s fit your energy strategy or if alternatives are more practical in the near term.

Technical Terms

Glossary terms mentioned in this article

Comments

Be the first to comment

Be the first to comment

Your opinions are valuable to us