Elon Musk's reported talks to merge his companies SpaceX, Tesla, and the newly launched xAI have sparked considerable debate across the tech and business worlds. This proposed combination promises to bring together important assets like the Grok chatbot, Starlink satellite network, and SpaceX's rocket technology, all under a single corporate umbrella. But what practical effects could this merger have, and is unifying such diverse technologies truly beneficial?

In this article, we explore the challenges this merger aims to solve, dissect the potential trade-offs, and highlight key considerations for stakeholders evaluating its impact.

How does a merger of SpaceX, Tesla, and xAI work?

At first glance, combining electric vehicles, space launch vehicles, satellite communications, and advanced AI chatbot platforms seems like a bold but unusual move. Each of these entities operates in highly specialized domains with very different business models and engineering requirements.

The key elements include:

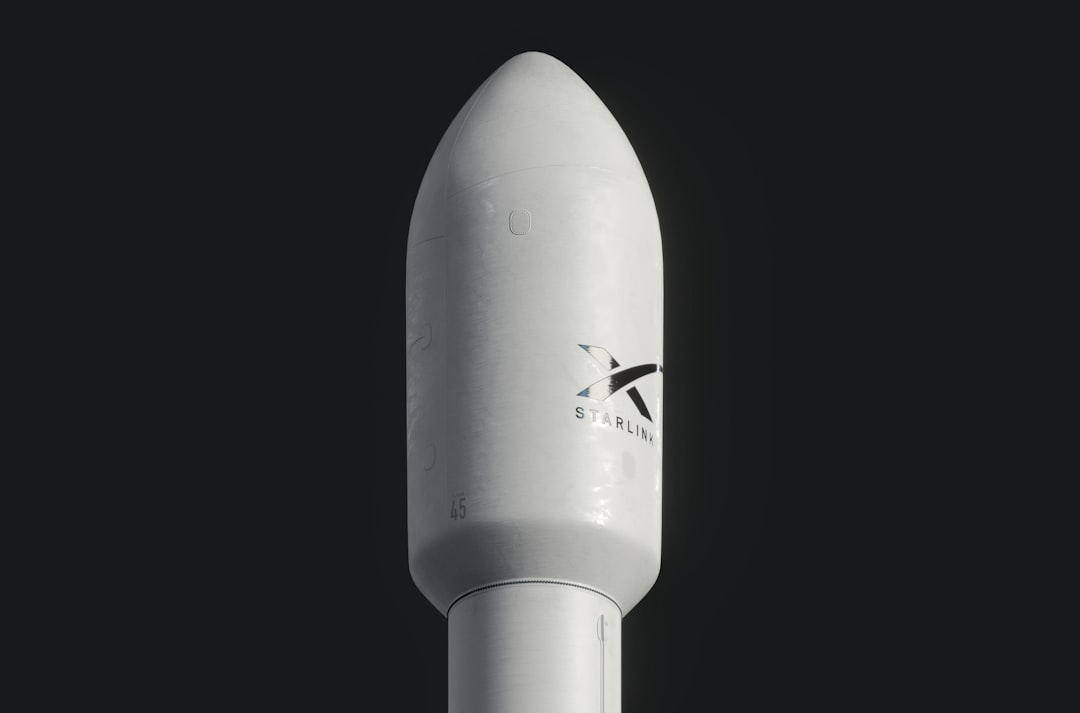

- SpaceX Rockets: A leader in aerospace, known for reusable launch vehicles that reduce cost and accelerate space access.

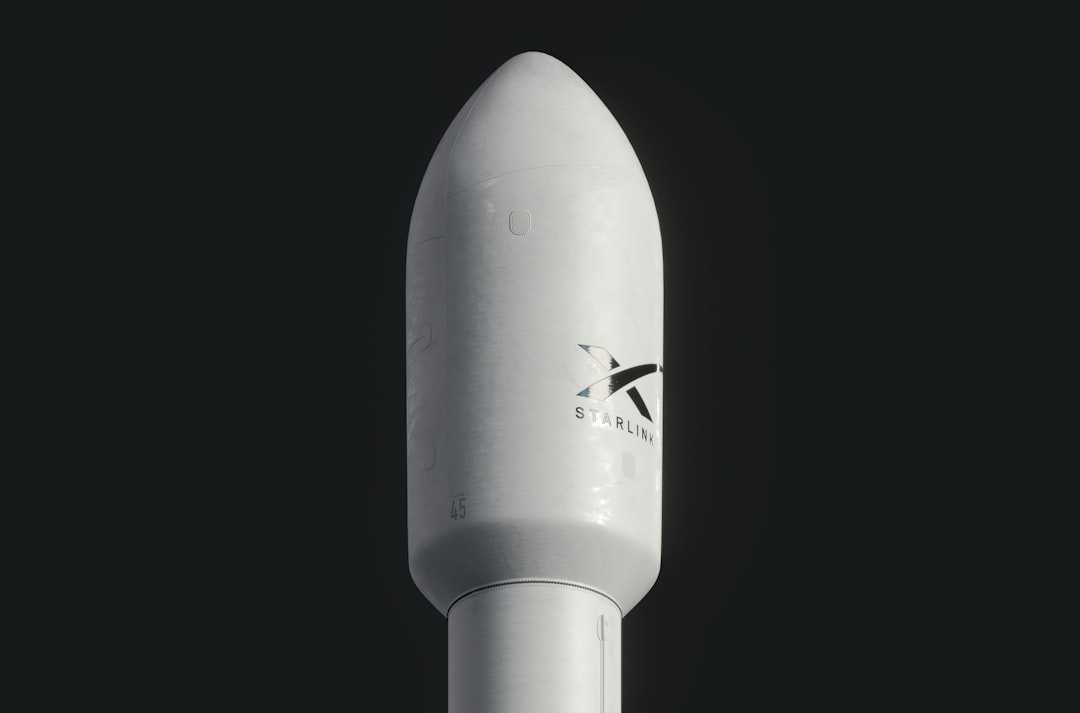

- Starlink Satellites: A satellite constellation providing global broadband internet — a rapidly growing telecommunications network.

- Tesla: A giant in electric vehicles and energy innovation with a massive manufacturing and software footprint.

- xAI and Grok chatbot: The artificial intelligence startup focusing on conversational AI, with Grok acting as a competitor or complement to existing chatbots.

The merger would centralize research, engineering, and operational assets to create potential synergy across AI-powered vehicle autonomy, satellite communications, and space tech. However, merging hardware-intensive companies with AI-driven software firms is inherently complex.

Why consider merging such different companies?

The merger could be driven by hopes to leverage cross-domain innovations. For example, AI developed in xAI might improve autonomous capabilities in Tesla vehicles or optimize Starlink satellite functioning. Similarly, data from Tesla cars combined with satellite internet data could feed powerful AI models for various applications.

Yet, skepticism remains reasonable. Many companies chase integration benefits only to discover culture clashes, divergent goals, and bureaucratic hurdles slow progress. SpaceX’s aerospace manufacturing follows a very different cadence and risk profile than Tesla’s automotive mass production or an AI startup’s agile development.

What are the trade-offs and challenges of this merger?

Complexity and Focus Dilution

One major challenge is managing vastly different business units under one roof without losing focus. SpaceX’s launch ambitions require intense long-term investment in reliability and safety, whereas Tesla’s trillion-dollar market value relies on high-volume vehicle manufacturing and energy products. AI companies require rapid iteration on software, often quite independent from hardware timelines.

Such divergent needs may lead to conflicts around resource prioritization, engineering incentives, and customer focus.

Regulatory and Financial Risks

The merger could attract heavy regulatory scrutiny. Combining telecommunications via Starlink, automotive manufacturing, aerospace, and AI under one company might raise antitrust concerns or compliance complications in multiple industries.

Financially, the integration process itself is costly and distracting. Investors often penalize conglomerates that appear unfocused, which could impact share price and fundraising ability.

Technical Integration Challenges

On a technical level, merging systems like the Grok AI chatbot with Starlink’s satellite infrastructure or integrating Tesla’s vehicle data with SpaceX rocket telemetry presents massive interoperability challenges. Retrofitting existing software and hardware stacks to talk to each other at scale is non-trivial and prone to failures.

How should stakeholders evaluate this proposed merger?

The decision to embrace or resist this integration depends largely on one’s perspective and risk appetite.

Investors should critically assess whether combining these businesses creates true long-term value or just diversifies risk awkwardly. Close attention to integration plans, leadership roadmaps, and timing is essential.

Employees and engineers may face changing priorities, culture shifts, and new collaboration demands. Transparent communication and clear mandate help mitigate morale risks.

Customers should watch for how products improve or degrade through convergence. Will satellites improve Tesla connectivity? Will Grok AI meaningfully enhance user experience or become lost in bureaucracy?

Practical Considerations: What are the costs, risks, and timeline?

- Timeframe: Effective mergers of this scale typically take multiple years to finalize and integrate fully.

- Cost: Integration costs run into billions due to restructuring, tech rewiring, and organizational changes.

- Risks: Loss of focus, regulatory pushback, technology complications, and market skepticism.

- Constraints: Diverse industries with different regulations and customer bases, plus Elon Musk’s management style may add unpredictability.

When should you support or oppose the merger?

If your goal is to see bold cross-pollination of AI and space tech that could unlock novel innovations, this merger appears promising. However, if you prioritize specialized focus and delivery excellence in each domain without distractions, the merger might introduce needless complexity and risk.

Keep in mind, mergers often look better on paper than in practice. History warns that though integrated tech giants can emerge successfully, they face steep internal hurdles requiring robust governance and aligned incentives.

Decision Checklist: Should You Bet on This Merger?

Spend 15-25 minutes answering the following:

- Do you believe AI can substantially improve aerospace and automotive operations?

- Are Tesla, SpaceX, and xAI’s cultures compatible enough to collaborate?

- Can regulatory risks be effectively mitigated?

- Are the financial costs of integration justified by long-term synergy opportunities?

- How critical is rapid innovation velocity for each business versus slow consolidation?

Answering these will offer clarity on whether this merger aligns with your strategic outlook or if you prefer the speed and focus of standalone entities.

The verdict on this large-scale merger remains pending, but understanding its complexities and trade-offs arms stakeholders with a clear lens on how to approach Elon Musk’s latest ambitious move.

Technical Terms

Glossary terms mentioned in this article

Comments

Be the first to comment

Be the first to comment

Your opinions are valuable to us